A Region in Trouble

Roger Bezdek is the president of MISI, in Washington, D.C. He has served as a senior advisor in the office of the Secretary of the Treasury and as research director at the Department of Energy. He is the author of six books and over three hundred publications in scientific and technical journals, including over a dozen articles in Public Utilities Fortnightly.

Acknowledgement: The U.S. Department of Energy provided funding for the analysis of these data. However, the paper does not necessarily reflect Administration policy.

The U.S. coal industry has been distressed for years, and the fate of U.S. coal mining regions and jobs, especially in Appalachia, figured prominently in the 2016 Presidential election. Coal mines have closed, coal power plants have shut down, and many jobs in coal-related industries have been lost.

In the 2017 Annual Energy Outlook, EIA forecasts that coal will continue to decrease as a source of U.S. electricity generation through 2050, even without the Clean Power Plan. It is important to determine the current state of the industry, jobs and potential future trends under different possible scenarios.

In Part I, we assess the recent past and current state of the U.S. coal industry, with emphasis on Appalachia. In Part II, we examine alternative scenario futures for the industry involving assumptions about economic growth, energy requirements, technologies, tax incentives, and research and development.

Coal History

Coal was the cornerstone of the U.S. energy supply for nearly two centuries. Oil eventually replaced coal in transportation and natural gas replaced coal in space heating. However, moderately priced coal as the basis of U.S. electricity generation enabled families to take advantage of a vast array of home appliances and provided manufacturers with affordable and reliable electricity.

Coal enabled the U.S. to electrify its cities and to power remote regions. In the 1920s, less than ten percent of farms had electricity. Thanks to the Rural Electrification Act of 1936, access to electricity steadily increased. At present, nearly all farms have electric power.

In 1950, the U.S. produced 560 million short tons of coal, 92 million of which were utilized to produce 155 BkWh of power - forty-six percent of U.S. electricity. By 2010, the U.S. produced 1,084 million short tons of coal and 975 million of those were utilized, to produce 1,847 BkWh.

As natural gas power plants replaced some aging coal plants and as anti-coal regulations increased, coal's role in electricity declined. By 2016, about one third of U.S. electricity was produced by coal.

At the same time, productivity in the coal industry increased rapidly due to a combination of easier-to-mine surface coal in the west and technological advances in mining. In 1950, productivity per miner was 0.76 short tons per hour; by 2010 productivity per miner had increased to 5.55 short tons per hour.

U.S. coal mining employment peaked in 1923 with 863,000 coal miners. Since then, employment has declined at the same time coal production has increased. The number of coal miners declined from 174,000 in 1985 to about 65,000 in 2015.

This was below the previous low of 70,000 in 2003, and was the lowest number of U.S. coal miners in a hundred and twenty-five years.

Over the second half of the twentieth century, coal lost market share in space heating and transportation, but gained significantly in electricity production. The U.S. still uses a large amount of coal, and over ninety percent of it is utilized for electric power.

Since 2010, increased natural gas generation and environmental regulations have reduced coal's role. But coal still plays a crucial role in electricity generation. In the spring of 2017, U.S. coal production increased fifteen percent year-over-year (2016 to 2017). However, it remains to be determined if this is a reversal of a longer-term trend of declining production or a temporary development.

The Importance of Appalachian Coal

Hundreds of communities have depended for generations on coal for their livelihood. The economic activity and the jobs created by coal mining have provided employment and income. Coal also brings a sense of purpose and pride to these communities and the families within them.

Further, since coal facilities are located in rural areas, the coal industry is frequently the major employer in the region. Many Appalachian communities are almost totally dependent on the coal industry to maintain at least modest prosperity, and the rapid decline of the industry in recent years has taken a heavy toll.

While many U.S. regions have prospered and grown in recent years, communities in coal country have endured a bleak spiral of poverty and population attrition. Coal company bankruptcies and mine closures have contributed to escalating social and economic difficulties. Those include drastic declines in tax revenues, outmigration, decreasing birth rates, school closures, breakdown of community services, and increases in social problems such as drug abuse.

The loss of coal mining jobs is devastating, since these are some of the highest paying jobs in the coal regions. For example, in Belmont County, Ohio, the average weekly wage of a service job is five hundred seventy-five dollars, whereas coal miners earn sixteen hundred dollars per week. In eastern Kentucky, coal mining jobs pay nearly three times the average wage.

The increased poverty associated with coal job losses is striking. In eastern Kentucky, twenty-six of thirty-one counties are ranked as distressed by the Appalachian Regional Commission. In many of these counties, poverty rates exceed thirty percent, and child poverty rates approach fifty percent.

In addition to reduced economic activity and job losses, a major driver of coal community problems is the decline in severance tax revenues. Coal producing states obtain substantial revenues from severance taxes. They utilize these to support government activities and fund counties to provide services. Decreasing tax revenues combined with continuing outmigration have placed local public health and safety services and school systems in jeopardy.

Appalachian Distress

Between 2000 and 2011, Appalachia contained about two thirds of all U.S. coal mining jobs. However, with the rapid decline of Appalachian coal mining, the Appalachian share of U.S. coal jobs declined to fifty-seven percent in 2015, its lowest point in fifteen years.

While the U.S. lost twenty-eight percent of its coal mining jobs from 2011 to 2015, coal mining jobs in Appalachia decreased by thirty-six percent. Nevertheless, Appalachia still provides most U.S. coal mining jobs, with the Illinois Basin and the Western Region each accounting for fewer than 20,000 jobs.

Between 2011 and 2015, Appalachia lost more than 23,500 coal mining jobs. About seventy-one percent of the Appalachian coal mining job losses were concentrated in Kentucky (more than 8,800 jobs lost) and West Virginia (more than 7,800 jobs lost).

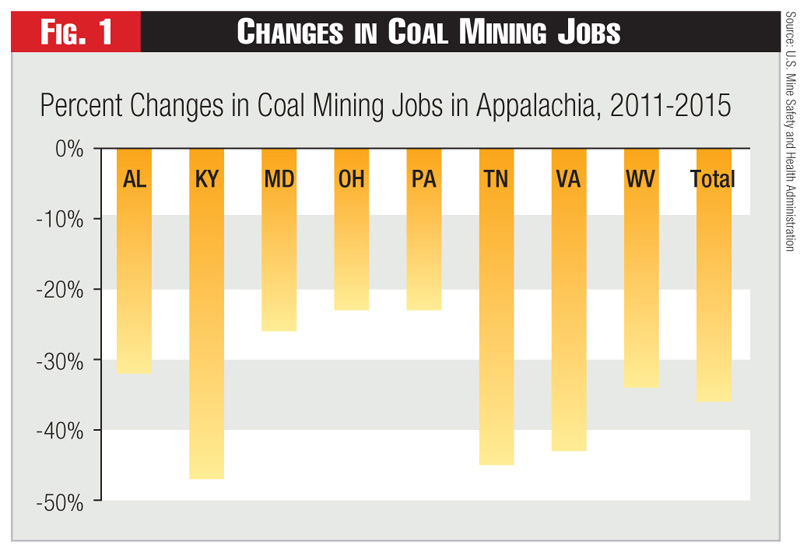

Figure 1 shows the percentage of coal jobs lost in each state and illustrates that. Kentucky, Tennessee, and Virginia lost more than forty percent of their coal mining jobs; West Virginia and Alabama lost in excess of thirty percent of their coal mining jobs; Maryland, Ohio, and Pennsylvania lost more than twenty percent of their coal mining jobs.

See Figure One.

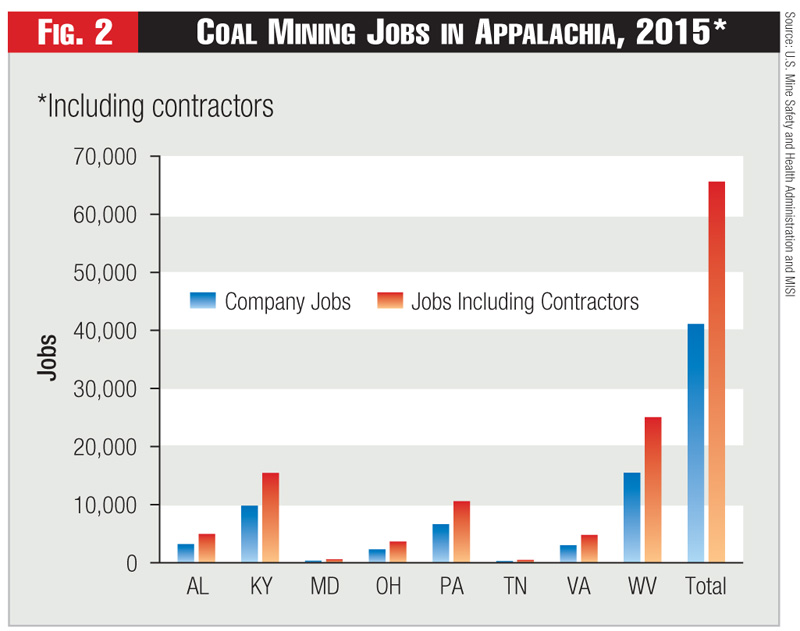

However, thirty to forty percent of total coal mining employment is comprised of contractors. These jobs data are included in national jobs estimates, but are not included in state estimates of coal mining employment.Exclusion of these contractor job estimates from state estimates results in a serious undercount of coal mining jobs and obscures the significance of the coal industry.

To provide more robust estimates of coal mining jobs by state in Appalachia, we prorated the contractor jobs to each Appalachian state according to the percentage that contractor jobs comprised of the national total in each year.

We estimated that including contractor jobs, coal mining employment in Appalachia totaled more than 95,000 in 2009, increased to over 102,000 in 2011, and decreased to about 65,600 in 2015.

As shown in Figure 2, in 2015, there were about 66,000 coal mining jobs in Appalachia - not 41,000.

Coal jobs in Appalachia increased more than seven percent between 2009 and 2011, then decreased sharply by fifty-three percent between 2011 and 2015. By 2015, employment was thirty-one percent lower than in 2009.

These jobs can be translated into total jobs, which are the sum of the direct and indirect jobs. Direct jobs are those created in the specific activity or process. Indirect jobs are those created throughout the required interindustry supply chain and in supporting or peripheral activities. Total jobs are the sum of all the jobs created.

See Figure Two.

We estimate that the Appalachian regional multiplier for coal mining jobs in Appalachia is about 2.5 and that the national multiplier for coal mining jobs in Appalachia is about 3.5. Thus, for every coal mining job in Appalachia we estimate that 2.5 jobs are created in the Appalachian region and 3.5 jobs are created in the U.S. as a whole.

For example, it is estimated that in 2011 the coal mining industry in Pennsylvania generated in the state nearly 13,900 jobs directly and about an additional 22,300 jobs indirectly. The 22,300 indirect jobs were in industries that supply goods and services to the coal industry, as well as in industries across the entire economy.

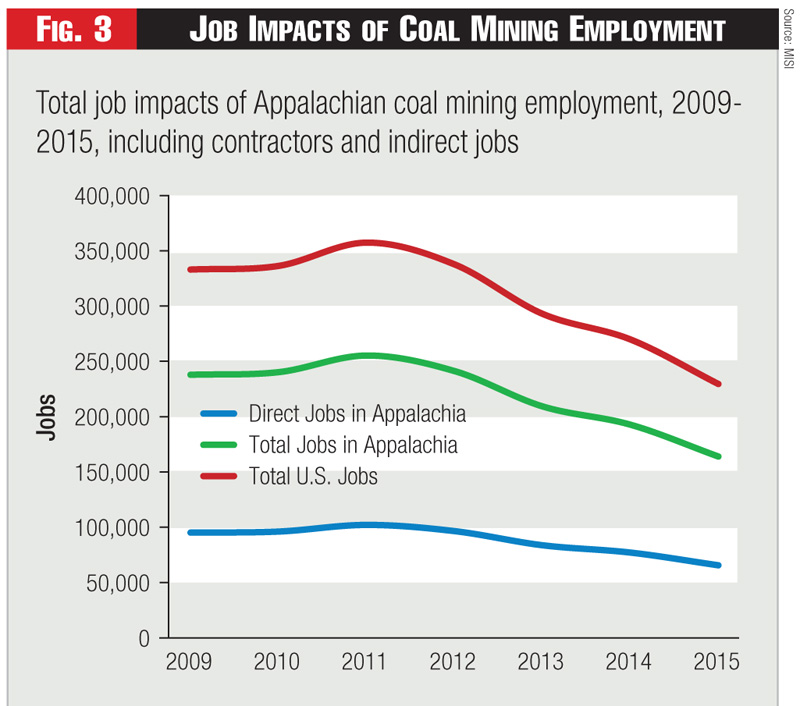

We estimate that, as illustrated in Figure 3, Appalachian coal mining jobs created a total of 238,000 jobs in 2009; a total of 255,000 jobs in 2011; a total of 164,000 jobs in 2015 overall in the Appalachian region.

Thus, 91,000 jobs in all, direct and indirect, were lost in Appalachia between 2011 and 2015 due to declining Appalachian coal employment.

Figure 3 indicates the number of coal mining jobs in Appalachia created in the U.S. as a whole. The chart shows a total of 333,000 jobs in 2009; a total of 357,000 jobs in 2011; a total of 230,000 jobs in 2015.

The total job loss in the U.S. between 2011 and 2015 due to declining Appalachian coal mining employment was 127,000 jobs. These estimates indicate that the employment impact of Appalachian coal mining is much greater than generally realized.

For example, conventional estimates indicate that Appalachia lost 23,000 coal mining jobs between 2011 and 2015. However, we estimate that the total impacts of the loss of Appalachian coal mining jobs between 2011 and 2015 were 91,000 jobs lost in Appalachia and 127,000 jobs lost in the U.S. as a whole.

See Figure Three.

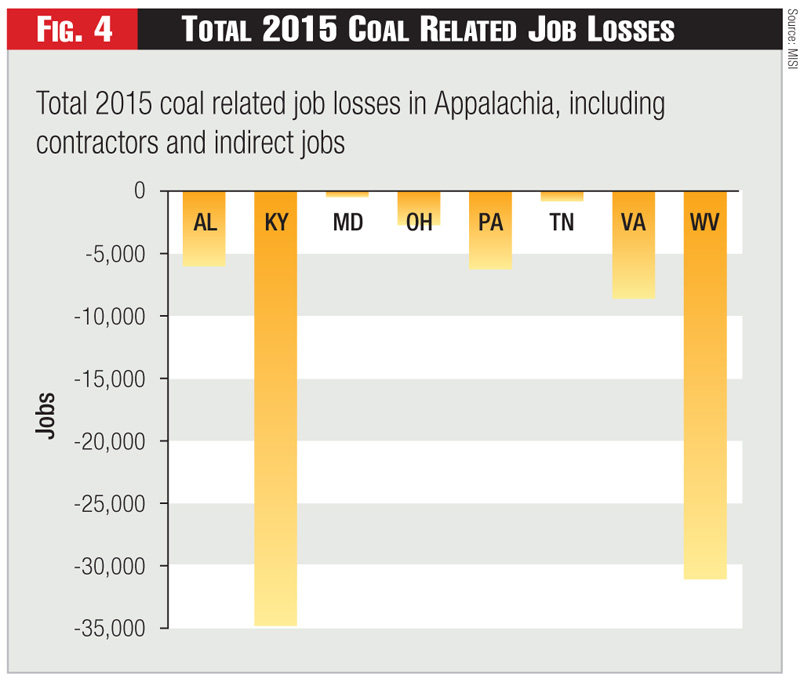

Figure 4 illustrates the actual total employment impacts in Appalachia of the loss of coal jobs between 2011 and 2015. It shows that 91,300 jobs were lost in these eight states. 34,900 jobs, nearly forty percent of the total, were lost in Kentucky. 31,100 - thirty-four percent of the total - were lost in West Virginia. Nearly three quarters of the jobs, 66,000, were lost in these two states.

Since the labor force in Kentucky is nearly three times as large as it is in West Virginia, the impact in the latter state was nearly three times as severe. The job losses in West Virginia comprised more than four percent of jobs in the state, whereas the job losses in Kentucky comprised less than two percent of jobs in the state.

Nevertheless, the loss of coal mining jobs was devastating in both states: Kentucky's 2015 unemployment rate was 5.4 percent. Absent the loss of nearly 35,000 coal-related jobs, the state's unemployment rate would have been about 3.5 percent. That is essentially considered full employment. Without the loss of coal-related jobs, Kentucky would have enjoyed full employment.

West Virginia's 2015 unemployment rate was 6.8 percent. Absent the loss of over 31,000 coal-related jobs, the state's unemployment rate would have been less than three percent, or full employment. That is, without the loss of coal-related jobs, West Virginia, instead of experiencing a recessionary unemployment rate of near seven percent, would have enjoyed full employment.

The coal-related job losses in Appalachia were actually four times as large as is generally supposed, and the job losses in the U.S. were nearly six times as large as is generally supposed. The loss of nearly 100,000 jobs in Appalachia over a five-year period had devastating consequences, especially for Kentucky and West Virginia.

In particular, West Virginia has been seriously harmed by recent coal mining job losses and is at risk for future job losses. Unfortunately, this state is especially vulnerable, since it is a relatively small state heavily dependent on coal mining. It lacks a diverse economy, unlike states such as Ohio, Pennsylvania, and Virginia. The state is one of the most impoverished in the U.S; among all the states, it has the lowest portion of its population employed - less than forty percent.

See Figure Four.

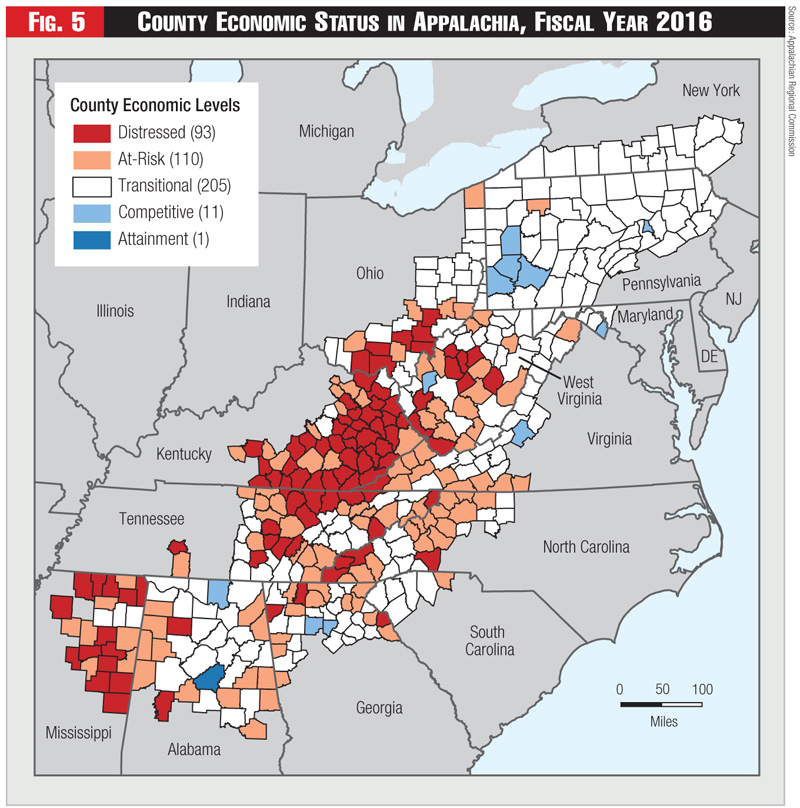

The loss of coal mining jobs is sorely felt in Appalachia, and Figure 5 illustrates an alarming economic situation. Of all Appalachian counties, ARC identifies 203 as either distressed or at-risk, only 11 as competitive, and only 1 as in attainment.

See Figure Five.

Even more troubling, ARC's rankings pertain only to direct coal jobs impacts, excluding contractors. As discussed, the total job impacts in Appalachia from coal mining job losses are four times as severe.

Thus, the negative impacts in the region of coal mining job losses are truly dire. However, if current coal mining jobs can be saved and new jobs created, the impacts in Appalachia - and in other U.S. coal mining regions - will be much more significant than is generally recognized.

Conclusion: What is Coal's Future?

The role of coal in the U.S. and particularly in Appalachia, has undergone significant transformation over the past century. The increasing importance of electricity and the concomitant demand for coal is probably the most significant change that has taken place.

The U.S. is at another crossroads. Specifically, the question is how much coal will be produced and utilized in the future and what will be the likely impacts on U.S. electricity generation, the economy, and jobs? Has the death of coal been greatly exaggerated?

We address these issues in Part II.

Category (Actual):

Department: